Financial Stability Forum Names New Head

By Martin de Sa'Pinto, Senior Financial Correspondent

BASEL, Switzerland (HedgeWorld.com) - Financial Stability Forum members have designated Mario Draghi as chairman of the FSF when Roger Ferguson Jr., vice president of the U.S. Federal Reserve, steps down at the end of this month. G7 Finance Ministers and central bank governors have confirmed their support for Mr. Draghi's nomination.

The FSF was set up in February 1999 to promote international cooperation in financial supervision and surveillance, and to enhance international financial stability by fostering the exchange of information across borders. It brings together committees of central bank experts, regulatory and supervisory authorities and international financial institutions, as well as senior finance officials from the G7 countries, Australia, the Netherlands, Hong Kong and Singapore.

It is Mr. Draghi's second high-profile appointment within a matter of months; he stepped in as governor of the Bank of Italy at the end of December 2005, replacing the controversy-prone Antonio Fazio, whose role in Banca Popolare Italiana's failed takeover of Banca Antonveneta is still being investigated by the Italian authorities. Already a well respected figure in both financial and political circles, Mr. Draghi's appointment as Bank of Italy governor brought to a close a situation that had turned from a minor scandal into a full-blown institutional crisis.

Mr. Draghi chaired the commission which drafted the 1998 law governing the Italian financial markets, effectively bringing corporate communications in Italy into the 20th century, with disclosure rules and shareholder protection legislation to match that of any advanced economy. But enforcement in Italy has remained weak, with companies and investors that flout the rules rarely subjected to anything more than token sanctions.

(c) 2006 Daily News; White Plains. Provided by ProQuest Information and Learning. All rights Reserved.

FJ-GF GIUSTIZIA FEDERALISTA

+ 39 329 85 30 842

Mestre Casella Postale 30

Mestre Venezia , Italia

http://www.federalistjustice.org

Ultimi Articoli

Neve in pianura tra venerdì 23 e domenica 25 gennaio — cosa è realmente atteso al Nord Italia

Se ne va Valentino, l'ultimo imperatore della moda mondiale

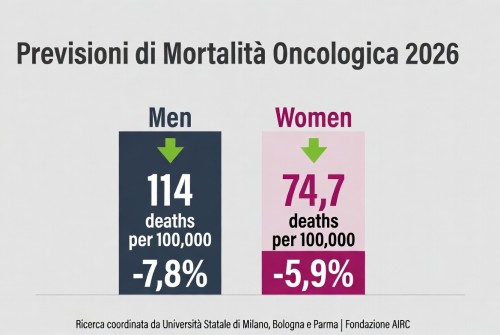

La mortalità per cancro cala in Europa – tassi in diminuzione nel 2026, ma persistono disparità

Carofiglio porta — Elogio dell'ignoranza e dell'errore — al Teatro Manzoni

Teatro per tutta la famiglia: “Inside and Out of Me 2” tra ironia e interazione

Dogliani celebra quindici anni di Festival della TV con “Dialoghi Coraggiosi”

Sesto San Giovanni — 180 milioni dalla Regione per l’ospedale che rafforza la Città della Salute

Triennale Milano — Una settimana di libri, musica, danza e arti sonore dal 20 al 25 gennaio

A febbraio la corsa alle iscrizioni nidi – Milano apre il portale per 2026/2027